Tax percentage calculator paycheck

Sign Up Today And Join The Team. Ad Payroll So Easy You Can Set It Up Run It Yourself.

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

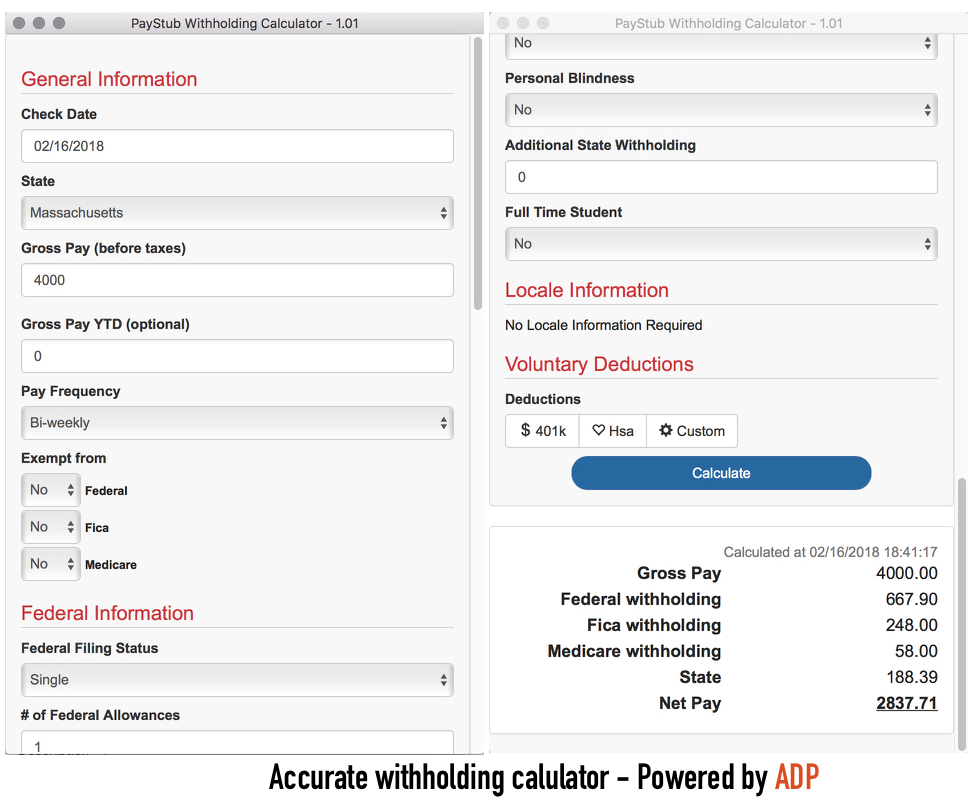

Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding.

. Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator. Learn About Payroll Tax Systems. The Social Security tax rate is 620 total including employer contribution.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local. Get Your Quote Today with SurePayroll. Make Your Payroll Effortless and Focus on What really Matters.

The tax rate is 6 of the first 7000 of taxable income an employee earns annually. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. California income tax rate.

Learn About Payroll Tax Systems. Ad Fast Easy Accurate Payroll Tax Systems With ADP. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

For more information about or to. Your average tax rate is 270 and your marginal tax rate is 353. Over 900000 Businesses Utilize Our Fast Easy Payroll.

See how your refund take-home pay or tax due are affected by withholding amount. Ad Compare Prices Find the Best Rates for Payroll Services. And is based on.

This marginal tax rate means that your immediate additional income will be taxed at this rate. Sign Up Today And Join The Team. Step 5 Additional withholdings.

For instance an increase of. All Services Backed by Tax Guarantee. Census Bureau Number of cities that have local income taxes.

Get Started Today with 2 Months Free. Use this tool to. Once you have worked out your tax liability you minus the money.

Your average tax rate is 220 and your marginal tax rate is 353. The formula to calculate tax liability. It is mainly intended for residents of the US.

Taxable income Tax rate Tax liability. Free salary hourly and more paycheck calculators. Ad Fast Easy Accurate Payroll Tax Systems With ADP.

Over 900000 Businesses Utilize Our Fast Easy Payroll. Taxable income 87450 Effective tax rate 172. 1240 up to an annual maximum of 147000 for 2022 142800 for 2021.

This marginal tax rate means that your immediate additional income will be taxed at this rate. If your company is required to pay into a state unemployment fund you may be eligible for a tax. Median household income in California.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. For instance an increase of. Your hourly wage or annual salary cant give a perfect indication of how much youll see in your paychecks each year because your employer also withholds taxes from your pay.

Estimate your federal income tax withholding. How It Works. Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set.

How To Calculate Payroll Taxes Methods Examples More

Payroll Tax What It Is How To Calculate It Bench Accounting

Take Home Pay Calc Flash Sales Save 44 Www Mctconsultancy Com

Withholding Calculator Paycheck Salary Self Employed Inchwest

Paycheck Calculator For Excel Paycheck Payroll Taxes Pay Calculator

Massachusetts Income Tax Calculator Smartasset

How To Calculate Federal Income Tax

How To Calculate Federal Income Tax

Federal Income Tax Fit Percent Method How To Calculate Fit Using Percent Method Youtube

How To Calculate Net Pay Step By Step Example

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

What Are Marriage Penalties And Bonuses Tax Policy Center

Understanding Pre And Post Tax Deductions On Your Paycheck

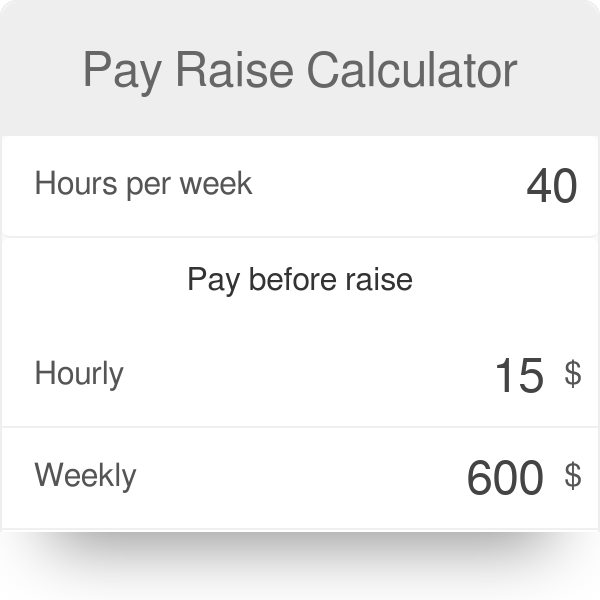

Pay Raise Calculator

O85z3nam6r 6km

Tax Payment Estimator On Sale 52 Off 360ski Bike Cl

Hourly Paycheck Calculator Calculate Hourly Pay Adp